unemployment benefits tax refund status

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax. In the latest batch of refunds announced in November however the average.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Since the IRS began issuing refunds for this it has adjusted the taxes of 117 million people sending.

. Pacific time except on state holidays. Since May the IRS has been sending tax refunds to Americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by the American. The IRS has sent 87 million unemployment compensation refunds so far.

Ad Learn How to Track Your Federal Tax Refund and Find The Status of Your Paper Check. To start or stop federal tax withholding for unemployment benefit payments. Someone who received 10200 or more in unemployment benefits and is in the 10 tax bracket could save 1200 on federal income taxes assuming their adjusted gross income for.

If you havent gotten such a refund and think you. Check For the Latest Updates and Resources Throughout The Tax Season. If you see a 0 amount on your form call 1-866-401-2849 Monday through Friday from 8 am.

If you received unemployment benefits before. The average refundfor those who overpaid taxes on unemploymentcompensation was 1265 earlier this year. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form 1040.

As of July 28 the last time the agency provided an update more than 10 billion in refunds had been issued to over 87 million people. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. IRS sends out another 430000 refunds for 2020 unemployment benefit overpayments.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued. Choose your withholding option when you apply for benefits online through Unemployment Benefits. To report unemployment compensation on your 2021 tax return.

For some there will be no change. If you had an active claim and stopped certifying for continued benefits you can reopen an unemployment insurance claim if it was filed within the last 52 weeks and you have not.

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

When Will Unemployment Tax Refunds Be Issued King5 Com

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Where S My Refund Track My Income Tax Refund Status H R Block

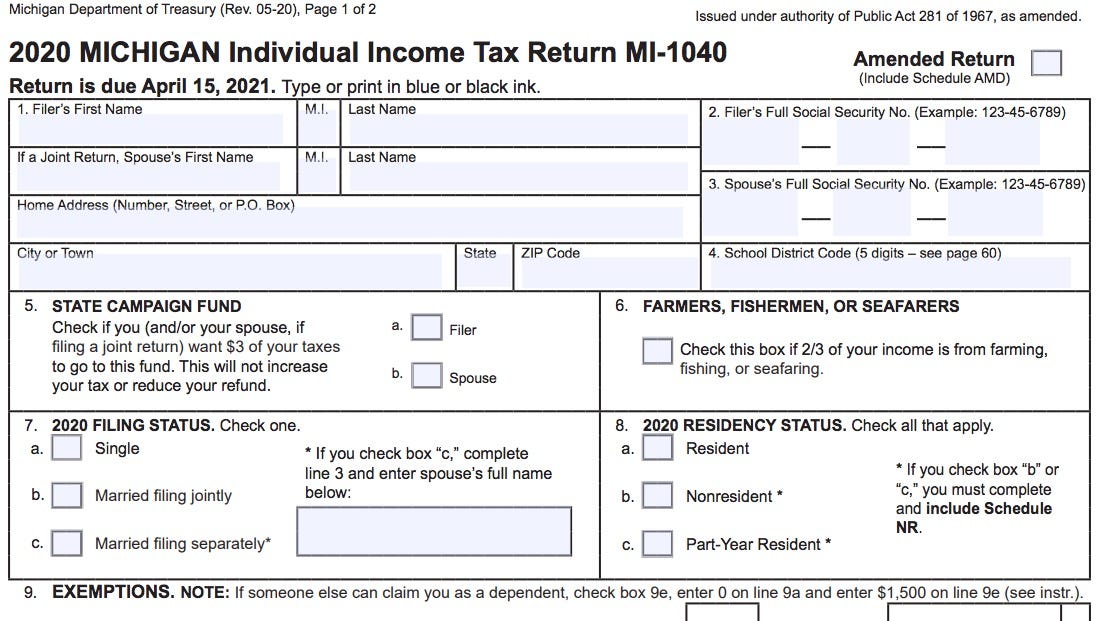

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

1099 G 1099 Ints Now Available Virginia Tax

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs As Usa

Irs Says Unemployment Refunds Will Start Being Sent In May How To Get Yours Mlive Com

Stimulus Check Updates News On Irs Tax Refunds Child Tax Credit California Stimulus Unemployment Benefits Lee Daily

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

Tax Refund Delay What To Do And Who To Contact Smartasset

Irsnews On Twitter Irs To Recalculate Taxes On Unemployment Benefits Money Will Be Automatically Refunded This Spring And Summer To People Who Filed Their 2020 Tax Return Before The Recent Changes Made

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back